Bupa Tax Exemption Form / Appeals court upholds federal tax exemption for clergy ...

An entity formed by splitting up or reconsutrctuon of an existing business shall not be considered a startup. For exemptions relating to tax warehouses, see exemptions for tax warehouses. With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget. Post getting clearance for tax exemption, the startup can avail tax holiday for 3 consecutive financial years out of its first ten years since incorporation. Eu countries may exempt certain supplies of goods and other transactions relating to tax warehouses and similar arrangements (referred to in the vat directive as 'warehouses.

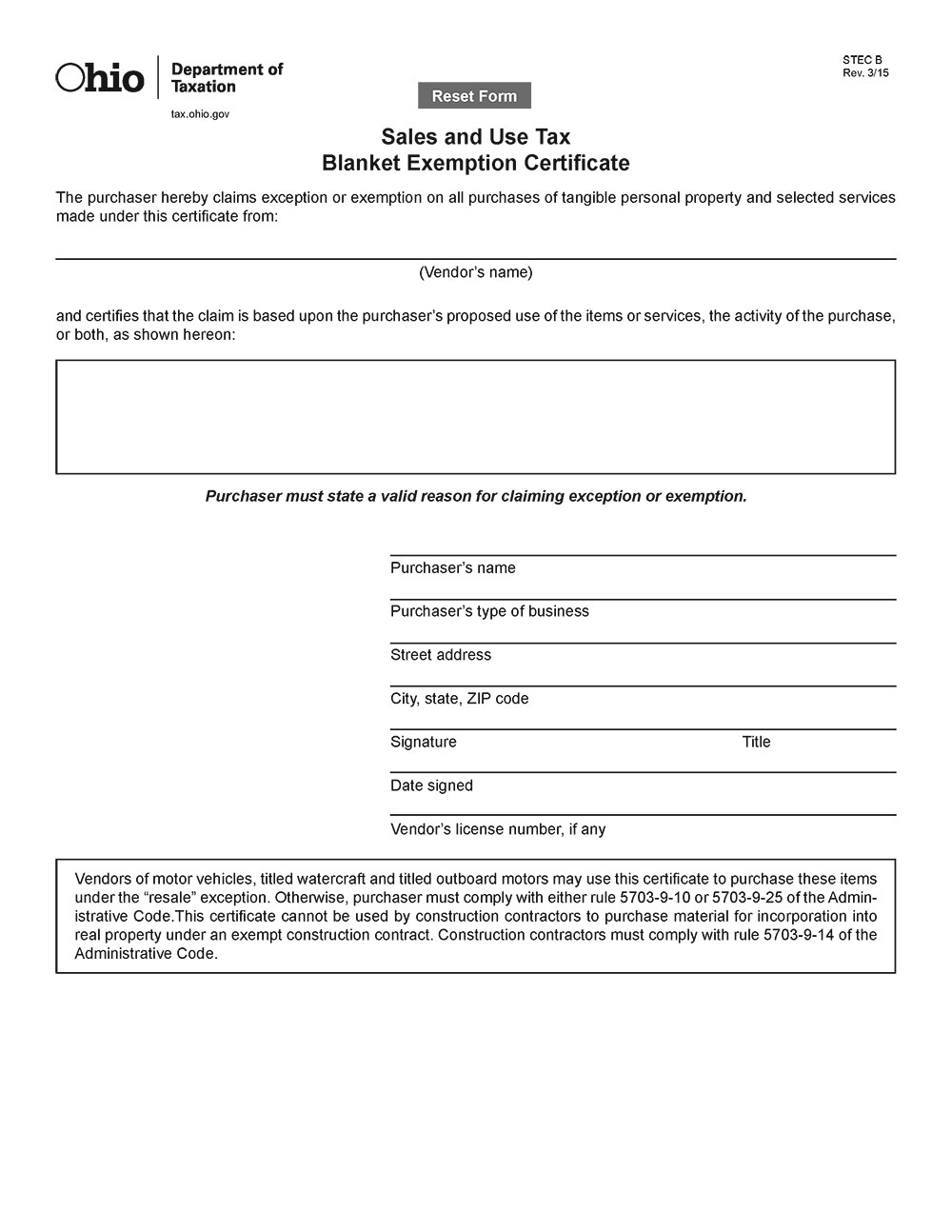

With the growth of country's economy, the amount of tax mounted on our shoulders increases exponentially, and with every new budget year period, the amount escalates. If the institution files irs form 990, return of organization exempt from income tax, provide a copy of the most recently completed form with the application. If you're a reseller we'll need a resale certificate, which is different than a seller's permit. Or do you have a valid reseller's certificate for a us state? Please refer to our disabled veterans exemption page for additional information, instructions for applying, and documentation that must be submitted along with this application. The government may wish to promote one form of business/income today and may want to promote another. Must these transactions be exempt? An entity formed by splitting up or reconsutrctuon of an existing business shall not be considered a startup.

These items are exempt from vat so are not taxable.

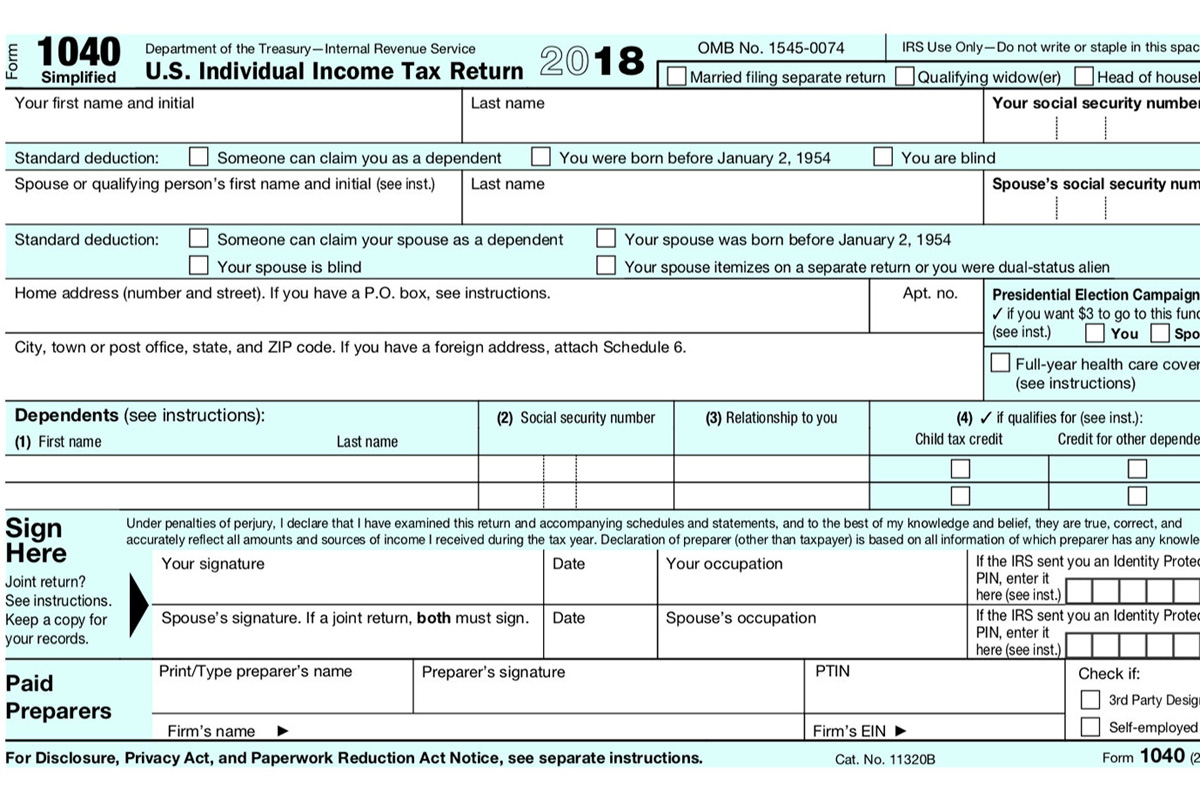

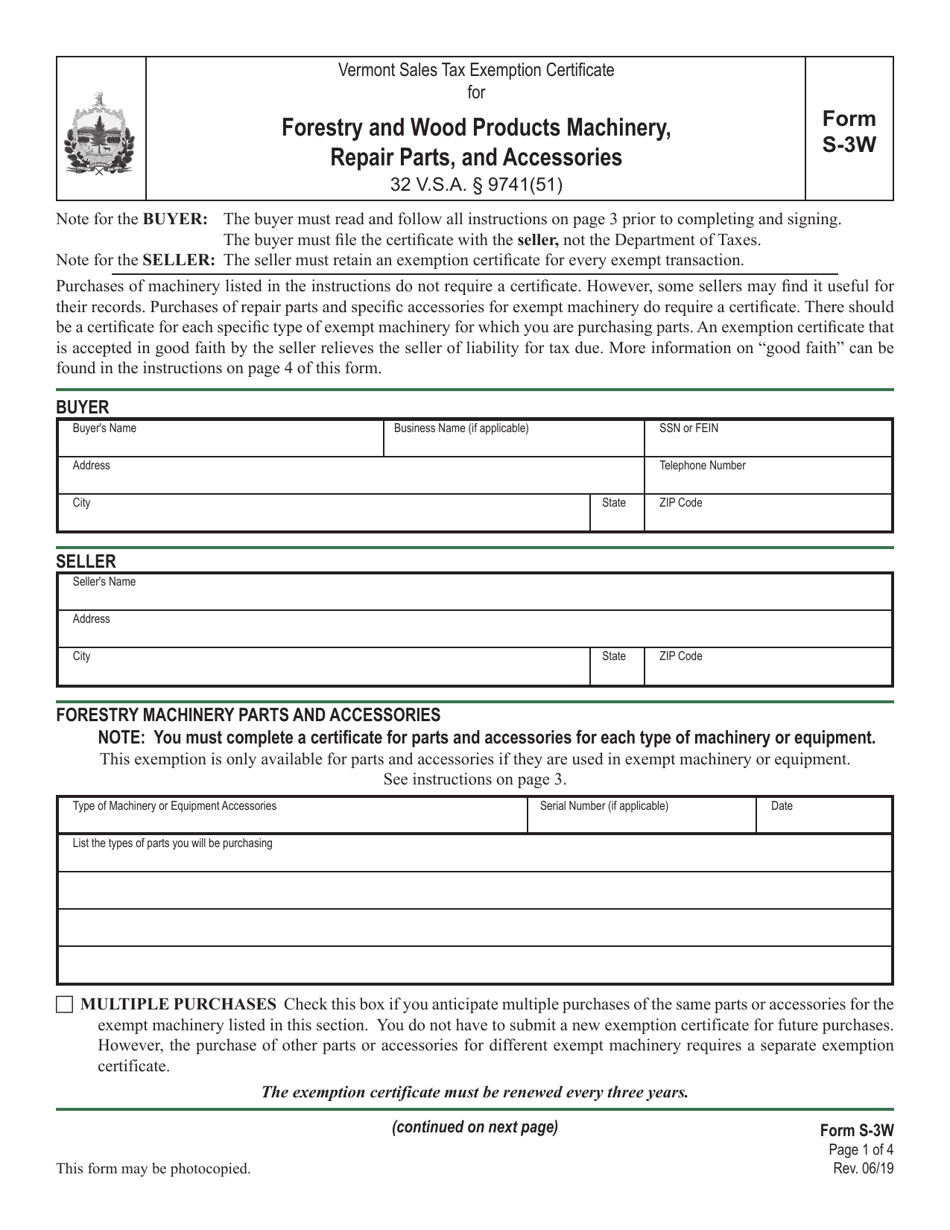

They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Exemptions were once available to almost all tax filers in the form of the personal exemption. Find federal forms and applications, by agency name on usa.gov. With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget. A taxpayer may buy an asset and subsequently sell that asset for a. Use this form to apply for the exemption for qualifying disabled veterans from local car or truck tax. The forms listed below are pdf files. Must these transactions be exempt? Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites. If your company is nonprofit or tax exempt, please find the appropriate form below and submit it to constant contact so we don't charge you sales tax (or note: Tax exemptions come in many forms, but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax.

Driving, traveling, home offices and student. Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Exemption numbers or exemption form* (if applicable). Use this form to apply for the exemption for qualifying disabled veterans from local car or truck tax. Tax exemption refers to a monetary exemption which decreases the taxable income. Commonwealth of virginia sales and use tax certificate of exemption.

(for use by a virginia dealer who purchases tangible personal property for resale, or for.

The tax amount will be refunded to the original form of payment. Post getting clearance for tax exemption, the startup can avail tax holiday for 3 consecutive financial years out of its first ten years since incorporation. Companies obtaining personal services from purdue request this form to verify purdue's tax identification number and exemption from tax withholding. Bupa insurance premium tax exemption form. If the institution files irs form 990, return of organization exempt from income tax, provide a copy of the most recently completed form with the application. We do not accept sales tax permits, articles of incorporation, tax licenses, irs determination letter (unless required by state law), w9's, or certificate of registrations for enrollment into the program. If you're a reseller we'll need a resale certificate, which is different than a seller's permit. Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does. Must these transactions be exempt? A taxpayer may buy an asset and subsequently sell that asset for a.

Must these transactions be exempt? Institutions seeking exemption from sales and use tax must complete this application. Know your forms (and the law).

Exemptions were once available to almost all tax filers in the form of the personal exemption.

Bupa insurance premium tax exemption form. Find federal forms and applications, by agency name on usa.gov. Listed below are the frequently visited states in which union college has determined its tax exemption status. Must these transactions be exempt? These items are exempt from vat so are not taxable. A taxpayer may buy an asset and subsequently sell that asset for a. If your company is nonprofit or tax exempt, please find the appropriate form below and submit it to constant contact so we don't charge you sales tax (or note: You may claim a tax exemption for tax year 2017 for each dependent if all of the following statements are true dependent tax exemptions can only be claimed on form 1040a or 1040. This tax break focuses on items you can deduct on your tax form on an ongoing basis, over the course of the year. Use this form to apply for the exemption for qualifying disabled veterans from local car or truck tax. Most taxpayers are entitled to an exemption on their tax return that reduces your tax bill in the same way a deduction does. You do not include sales of exempt goods or services in your taxable turnover for vat purposes. This is known as exempt input tax. Visit gsa smartpay to find state tax exemption forms and/or links directly to state websites. A tax exemption form is usually used to keep an organization that has been granted tax exempt status from having to pay taxes, such as sales taxes or a use or excise tax.

With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget.

Institutions seeking exemption from sales and use tax must complete this application.

Use this form to apply for the exemption for qualifying disabled veterans from local car or truck tax.

This tax break focuses on items you can deduct on your tax form on an ongoing basis, over the course of the year.

Exemption numbers or exemption form* (if applicable).

Or do you have a valid reseller's certificate for a us state?

You do not include sales of exempt goods or services in your taxable turnover for vat purposes.

Institutions seeking exemption from sales and use tax must complete this application.

With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget.

Use this form to apply for the exemption for qualifying disabled veterans from local car or truck tax.

Must these transactions be exempt?

Must these transactions be exempt?

With the growth of our country's economy, the amount of tax that we need to bear has gone up, and with each passing budget.

Must these transactions be exempt?

Bupa insurance premium tax exemption form.

Tax exemptions let individuals and organizations avoid paying taxes on some or all of their income.

Exemption numbers or exemption form* (if applicable).

These items are exempt from vat so are not taxable.

As this is at the state level, your 501(c) letter from the internal revenue service (irs) isn't sufficient documentation for tax exemption from.

Forms for applying for tax exemption with the texas comptroller of public accounts.

These items are exempt from vat so are not taxable.

Please do not send us a.

A tax exemption form is usually used to keep an organization that has been granted tax exempt status from having to pay taxes, such as sales taxes or a use or excise tax.

Must these transactions be exempt?

This is known as exempt input tax.

This is known as exempt input tax.

Tax exemption helps in curtailing the burden of taxable income during a financial year.

We do not accept sales tax permits, articles of incorporation, tax licenses, irs determination letter (unless required by state law), w9's, or certificate of registrations for enrollment into the program.

Tax exemption refers to a monetary exemption which decreases the taxable income.

Tax exemptions come in many forms, but one thing they all have in common is they either reduce or entirely eliminate your obligation to pay tax.

This tax break focuses on items you can deduct on your tax form on an ongoing basis, over the course of the year.

Posting Komentar untuk "Bupa Tax Exemption Form / Appeals court upholds federal tax exemption for clergy ..."